The Forex market offers vast opportunities for traders, and one of the most sought-after commodities is gold. trading gold forex Platform Forex provides valuable insights and tools for traders looking to invest in gold. In this article, we will explore the nuances of trading gold in the Forex markets, covering the factors influencing gold prices, strategies for successful trading, and tips for maximizing your profits.

Understanding Gold in the Forex Market

Gold has been a store of value for centuries and continues to hold a crucial position in the global economy. In the Forex market, gold is primarily traded as a commodity and is often expressed in terms of its price per ounce, usually quoted in USD. Traders can profit from fluctuations in gold prices, which are influenced by various factors including economic data, geopolitical tensions, and market sentiment.

Factors Influencing Gold Prices

Understanding the factors that affect gold prices is essential for any trader. Here are some of the key elements:

- US Dollar Strength: As gold is priced in USD, the strength or weakness of the dollar directly impacts gold prices. A stronger dollar typically results in lower gold prices, while a weaker dollar can lead to higher prices.

- Inflation and Interest Rates: Gold is often seen as a hedge against inflation. When inflation rises, investors tend to flock to gold, increasing its price. Similarly, lower interest rates make gold more appealing since it has no yield.

- Geopolitical Tensions: During times of uncertainty, such as political unrest or economic crises, gold often experiences a surge in demand. Traders closely monitor global events that might influence investor behavior.

- Global Economic Indicators: Economic reports such as the Non-Farm Payrolls, GDP growth rates, and manufacturing indices can all have an impact on gold prices.

Gold Trading Strategies

There are several strategies traders use to capitalize on gold price movements. Here are a few popular strategies:

1. Trend Following

This strategy involves analyzing trends in gold prices over time to predict future movements. Traders use technical analysis tools such as moving averages or trend lines to identify the overall trend and make trades accordingly.

2. Breakout Trading

Breakout trading centers around identifying key support and resistance levels. When the price of gold breaks above resistance or below support, it can indicate a potential future movement. Traders often enter trades in the direction of the breakout, hoping to ride the momentum.

3. Hedging

For traders holding significant positions in other assets, gold can serve as a hedge against potential losses. For example, if you’re concerned about a downturn in the stock market, you might increase your allocation to gold to mitigate this risk.

4. Scalping

Scalping involves making quick trades to profit from small price changes. It requires a keen eye on market movements and often utilizes technical indicators for timely decision-making.

Tools and Resources for Gold Trading

To effectively trade gold in the Forex market, traders should leverage a variety of tools and resources:

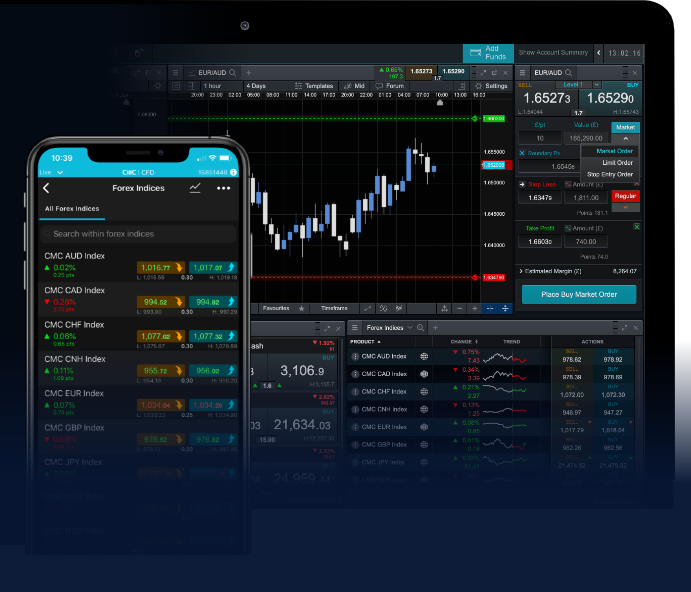

1. Trading Platforms

Choosing the right trading platform is crucial. It should provide quick execution speeds, advanced charting tools, and a user-friendly interface. Platforms like Platform Forex can offer all these features along with educational resources and market analysis tools.

2. Technical Analysis Tools

Using indicators such as Relative Strength Index (RSI), Bollinger Bands, and Fibonacci retracements can enhance trading decisions. Chart patterns, including head and shoulders, double tops, and triangles, can also signal potential trades.

3. Economic Calendars

Staying updated on economic events that could impact gold prices helps traders make informed decisions. An economic calendar lists important dates and events that could lead to volatility in the markets.

Key Tips for Successful Gold Trading

Here are some essential tips to keep in mind while trading gold in the Forex market:

- Stay Informed: Regularly follow news that can affect gold prices. This includes economic reports, central bank announcements, and geopolitical news.

- Use Proper Risk Management: Set stop-loss and take-profit levels for every trade. Never risk more than you can afford to lose, and consider diversifying your portfolio.

- Review and Analyze Your Trades: Keeping a trading journal can help you analyze your profit and loss over time. Learn from your mistakes and successes to refine your trading strategy.

- Practice with a Demo Account: Before risking real money, practice your strategies on a demo account to gain confidence and experience without financial risk.

Conclusion

Trading gold in the Forex markets can be an exciting and potentially lucrative endeavor. By understanding the factors influencing gold prices, employing the right strategies, and utilizing effective tools, traders can position themselves for success. Always remember to approach gold trading with a well-thought-out plan and disciplined risk management for optimal results. As you dive into the world of gold trading, platforms like Platform Forex can be invaluable resources for education and market insights.