Welcome to the world of forex position trading, a method that emphasizes looking at the bigger picture for maximizing profits. In this exploration of position trading, we will discuss key concepts, strategies, and the importance of patience and discipline in trading. If you are considering trading through forex position trading Thailand Brokers, understanding this trading style will help you make informed decisions and potentially enhance your trading success.

Understanding Forex Position Trading

Position trading is a long-term trading strategy that involves holding a position for an extended period, ranging from several weeks to several months, or even years. Unlike other trading styles, such as day trading or swing trading, position trading focuses on fundamental analysis and aims to capture large price movements over time.

The Philosophy Behind Position Trading

The core philosophy of position trading revolves around the idea of analyzing broader market trends rather than getting caught up in the daily price fluctuations. Position traders believe that with thorough research and a solid understanding of market fundamentals, they can make informed decisions that yield substantial returns over the longer term.

Key Characteristics of Position Trading

- Long-term Focus: Position traders typically hold their trades for weeks, months, or even years. This long time frame allows them to take advantage of macroeconomic trends.

- Fundamental Analysis: This trading style relies heavily on fundamental analysis, including economic indicators, interest rates, and news events that may impact the foreign exchange market.

- Reduced Frequency of Trades: Unlike day traders who can execute multiple trades in a single day, position traders take fewer trades, which means less stress and fewer transaction costs.

Strategies for Successful Position Trading

While position trading might seem straightforward, it does require a strategic approach. Here are some strategies that successful position traders often employ:

1. Comprehensive Market Research

Before entering a trade, position traders should conduct extensive research. This research includes analyzing economic indicators, geopolitical events, and any news that could affect currency pairs. Tools such as economic calendars can be instrumental in this phase, allowing traders to anticipate important announcements and potential market reactions.

2. Technical Analysis

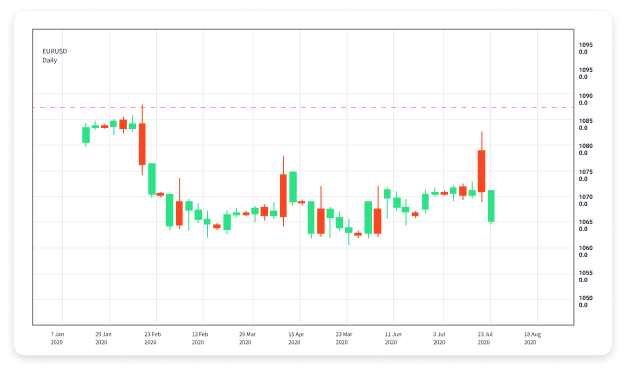

Even though position trading is primarily based on fundamental analysis, incorporating technical analysis can enhance decision-making. Utilizing charts, identifying key support and resistance levels, and using indicators can help traders spot optimal entry and exit points.

3. Setting Up Stop Loss and Take Profit Orders

Proper risk management is crucial in position trading. Traders should utilize stop-loss orders to limit potential losses and take-profit orders to secure gains when the price reaches a predetermined level. This dual approach reduces emotions from trading decisions and ensures a disciplined strategy.

Risk Management in Position Trading

Risk management cannot be overstated in position trading. Since trades can last for long periods and may be subjected to significant price movements, traders must manage their risks effectively.

Diversification

Diversifying across various currency pairs can help mitigate risks. Instead of placing all capital into one trade, traders should spread their investments to protect against adverse movements in a single currency.

Regular Review of Trades

While position traders spend less time monitoring their trades daily, a regular review is essential to adjust strategies based on changing market conditions. This might involve re-evaluating the position if new economic data releases or geopolitical events occur.

The Importance of Patience and Discipline

One of the hallmarks of successful position trading is patience. In a world where instant gratification is commonplace, waiting for the right market conditions can be challenging. However, it is essential to stick to your trading plan and avoid making impulsive decisions based on short-term market noise.

Similarly, discipline is critical. Traders should adhere to their strategies and avoid emotional trading, which can lead to losses. Keeping a trading journal can be beneficial, allowing traders to reflect on their decisions and learn from their experiences.

Conclusion

Forex position trading offers an intriguing avenue for traders looking to capitalize on longer-term market trends. By emphasizing fundamental and technical analysis, adopting a disciplined approach, and implementing robust risk management strategies, traders can navigate the forex market with greater confidence. As you embark on your position trading journey, remember that patience and informed decision-making will be your best allies. Embrace the learning process, and you may find position trading to be a rewarding endeavor.

Final Thoughts

In summary, mastery of position trading requires a blend of research, strategy, and emotional control. Whether you are a seasoned trader or just starting, understanding the principles of position trading can significantly enhance your trading experience and success in the volatile forex market. Take the time to cultivate these skills, and enjoy the potential benefits that well-timed position trades can offer.