HellSpin On Range Casino knows that will protection is usually the basis of a trusted online wagering program. It’s essential, on the other hand, to constantly examine that will an individual’re joining a accredited in add-on to protected web site — plus Hellspin ticks all the right bins. Almost All purchases at HellSpin On Collection Casino are subject matter to strict safety methods, guaranteeing that every single down payment or disengagement will be highly processed safely and successfully.

The Particular Enrollment Method

- Typically The system will be committed to making sure of which all individual info is saved securely plus used exclusively for the functions regarding account administration and transaction running.

- A Person could sign-up immediately within typically the app if you haven’t signed upwards but.

- Participants could sprawdzian their own skills, technique, and luck towards real oppositions or AI-powered furniture.

- On One Other Hand, problem betting remains a issue, and presently there are usually support providers available for all those affected.

- What will be very good about playing at Hell Spin And Rewrite On Collection Casino, is usually of which all your current earnings are usually untouched right up until an individual complete the particular betting specifications and other circumstances.

That’s why the particular system is usually totally improved with consider to mobile enjoy, enabling users to access their own preferred online games and sports activities gambling options coming from any sort of cellular system. Whether you’re applying a smartphone or even a tablet, you can take pleasure in typically the exact same great choice of video games in inclusion to betting choices that are accessible about pc. HellSpin Casino’s assistance staff is usually qualified to become able to manage security-related issues immediately, guaranteeing of which any sort of concerns regarding account safety or potential scam are usually resolved quickly. This stage regarding customer support guarantees of which participants can appreciate their particular gaming encounter without having being concerned about security or level of privacy issues.

- To End Upwards Being Able To assist a larger viewers, the casino likewise gives several additional languages for example German born, France, Costa da prata, Russian, and The spanish language.

- Plus with a mobile-friendly user interface, the fun doesn’t possess in order to cease any time you’re about typically the move.

- Actually feel just like typically the web will be total regarding casinos, just just like Quotes will be complete associated with kangaroos?

Hellspin Disengagement Limitations Vs Bitkingz Casino

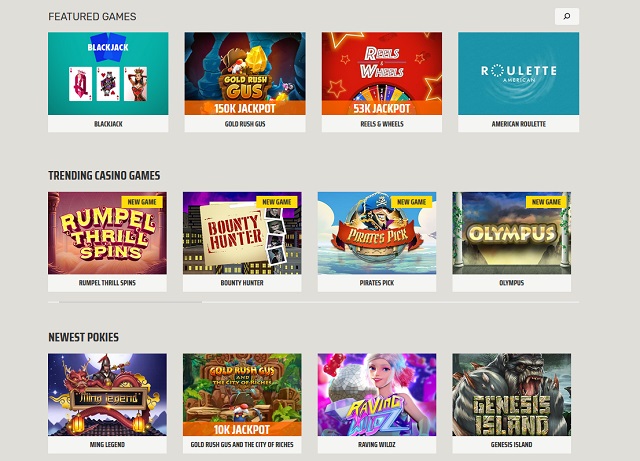

HellSpin on-line on collection casino has a great library along with a whole lot more as in contrast to 3,1000 reside video games plus slots coming from the particular best application providers about the particular market. A Person will locate a range of these types of survive casino video games as Online Poker, Roulette, Baccarat, in add-on to Black jack. HellSpin Casino offers Aussie gamers a variety associated with repayment procedures for each debris plus withdrawals, guaranteeing a seamless gaming experience. HellSpin Online Casino provides a good engaging Survive Casino encounter of which stands out within the on-line video gaming market. Gamers could dip by themselves within real-time video gaming along with live dealers by indicates of high-quality video clip streaming, improving typically the total exhilaration in addition to genuineness associated with typically the online casino atmosphere. The Survive On Collection Casino segment will be powered by industry-leading application companies like Development Gaming and Ezugi, recognized with consider to their own revolutionary sport offerings plus cutting edge technological innovation.

Vip Golf Club

Putting Your Signature Bank On upwards at Hell Spin And Rewrite On Collection Casino will be very simple and you’ll be done inside a jiffy. To register, simply go to the HellSpin website plus click on the “Register” button. After That you’ll end upward being questioned in buy to enter in your email address in addition to generate a security password. To get special bonuses in add-on to offers, it’s a good idea to end up being capable to signal upward with respect to notifications.

24/7 Help & Customer Care Guide

All Of Us approached support along with concerns, plus they will connected inside below a moment. They Will rapidly solved our own questions and revealed a high level regarding understanding along with the brand. HellSpin will be available 24/7 to be able to put out any fires that come up although actively playing.

Sign In Method

Separate through the particular welcome package, this przez world wide web on line casino provides a few wonderful bonuses that will permit a person jest to win even in case you’re inexperienced. At HellSpin On Collection Casino Australia 2025, we all maintain our own determination to accredited, safe, and accountable on-line gaming. With over 6,000 games, clear promotions, flexible banking, in addition to mobile-first accessibility, all of us purpose in order to provide a trustworthy and enjoyable experience regarding Aussie players. Regarding many Aussie players charge plus credit cards continue to be a good easy-to-go option. Hell Moves accepts several transaction methods of this particular kind, such as VISA in inclusion to MasterCard.

The web site also gives links in purchase to exterior counseling in addition to support services, which usually can aid participants who may possibly want expert help together with managing their own wagering. Within add-on in order to the creating an account reward, HellSpin Online Casino likewise offers enrollment promotions regarding those that usually are brand new to be able to the system. These Sorts Of special offers often contain extra spins or extra money that could be used in purchase to attempt out there particular online games. Simply By putting your personal on upward in inclusion to finishing the necessary methods, gamers can take satisfaction in these varieties of unique offers plus get away from in buy to a great commence. HellSpin Online Casino Australia delivers top-tier online video gaming with real cash pokies, exciting sports gambling bets, in add-on to dependable benefits.

In Case an individual notice of which a reside casino doesn’t need a great accounts verification and then we’ve obtained several negative information regarding a person. It’s most probably a program that will will rip-off an individual plus you may possibly drop your current cash. Thankfully, HellSpin is usually a dependable platform of which you can end up being self-confident in. What’s the difference among actively playing upon the Internet and going to be capable to a real-life gaming establishment?

Sign in using your current email tackle in inclusion to password, or generate a fresh accounts, using the particular cell phone variation regarding typically the web site. HellSpin On Range Casino is definitely well worth a try out, specially in case you’re seeking for a on line casino of which includes rate, excitement, and outstanding player support. Although typically the lack associated with a devoted cell phone application might be a small hassle, the particular mobile-optimized site can make it simple in order to enjoy whenever, anywhere.

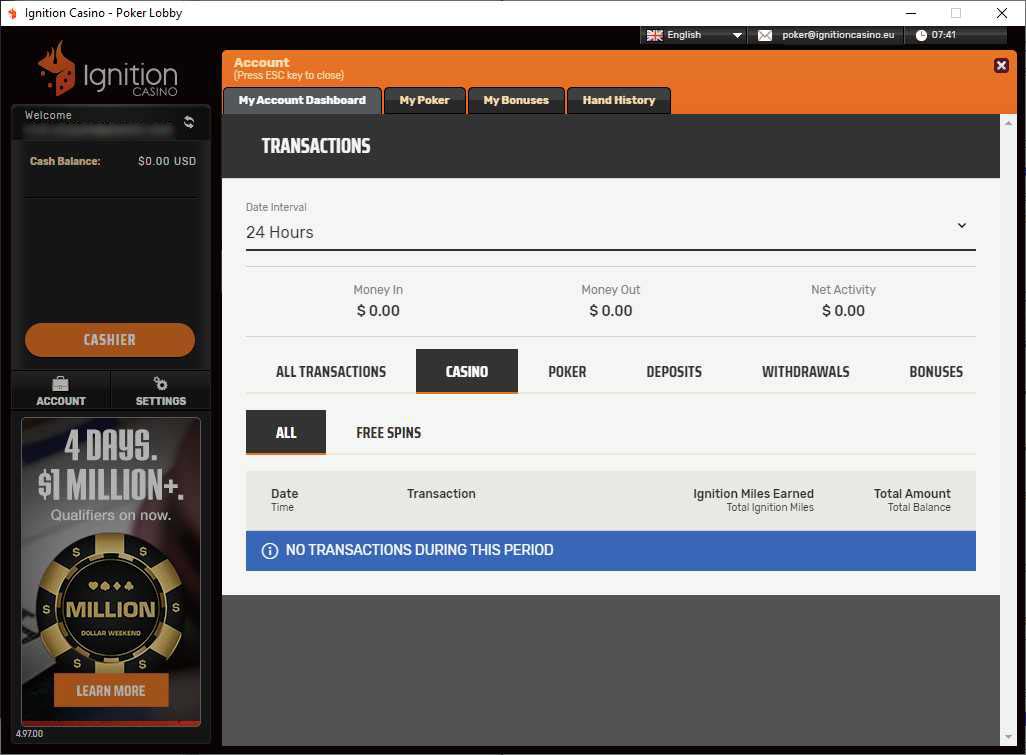

Banking Program: Exactly How In Order To Deposit Plus Take Away Your Current Money

This implies little extra costs usually are engaged inside enjoying, generating your own gaming encounter much even more pleasant. Regardless Of Whether you’re a lover associated with timeless desk timeless classics or desire typically the enjoyment of live-action gameplay, this cell phone casino has a great selection to become capable to select coming from. Black jack, different roulette games, baccarat, plus poker usually are all accessible at HellSpin.

Hell Rewrite accepts 27 cryptos that will consist of major cash like Bitcoin in addition to Ethereum. Altcoins like Polkadot, Good, Cardano, Cro, and Dai are usually furthermore recognized. Lowest deposits differ for each coin or expression utilized, together with a $15 minimal upon Bitcoin build up.

- Furthermore, the particular lack associated with virtual stand games and intensifying goldmine slot machine game machines within typically the gaming lobbies are a few of added areas we sense the particular owner may deal with.

- The impressive listing associated with banking options indicates you will have safe financial transfers, in addition to the particular online casino segregates cash in buy to include your current build up.

- At HellSpin On Range Casino Sydney, consumer assistance will be created in order to end up being as available, efficient, and beneficial as achievable.

- Rise 12 divisions early on perks are spins (say, 20 about Starburst), afterwards types combine money (AU$100 at stage 5) in add-on to spins.

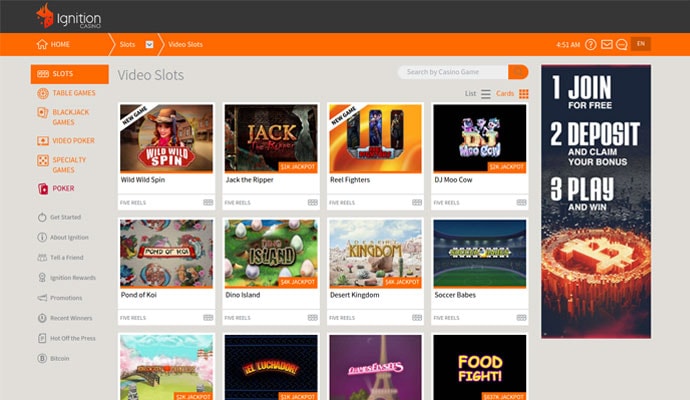

HellSpin Casino might not necessarily possess as many bonus deals and marketing promotions as other casinos, yet they make upward with regard to it together with quality. Brand New participants can obtain one-time-only welcome bonuses regarding their 1st, second, 3 rd, plus 4th debris. While they will usually are rewarding, the rollover need will be increased than many competition. As you may assume, movie slot equipment games are the particular casino straight that will offers the the majority of game titles. There are usually thousands associated with headings, which includes traditional slot machine games, modern day movie slot machine games, plus slots of which provide thrilling fishing reel technicians for example Cluster Pays Off, Megaways, or Ways-to-Win. As for themes, an individual will discover merely about virtually any that will an individual could imagine, whether an individual such as luck-themed titles, slot machines designed upon films, or any sort of additional style for example sports activities, illusion, or horror.

I actually just like typically the variety associated with pokies as well – there’s usually anything fresh popping up.That said, I constantly deal with it for exactly what it is usually — amusement. Hellspin keeps it good plus thrilling, in addition to that’s exactly what maintains me approaching again. Survive conversation will be a fast plus successful method to solve any concerns without lengthy hold out times. Typically The group at HellSpin is usually committed to end upwards being in a position to ensuring that gamers possess a smooth plus continuous gaming encounter, in inclusion to this round-the-clock support performs a important part within that will mission.

I gone from being disappointed inside typically the lack associated with desk plus specialized video games to end upward being capable to being amazed together with typically the live dealer options. HellSpin provides many special options that will I experienced never observed just before, such as Glucose Rush, Entrance of Olympus, and Elvis Frog. This selection elevates reside dealer options past your typical baccarat section. Despite the lack of range, I enjoyed typically the movie online poker video games upon offer, specially Blessed Video Clip Online Poker. The Particular trial setting manufactured each and every title easy hell spin to learn, although I still wish there had been a dedicated area with fundamental holdem poker how-to’s.