Disengagement alternatives provided by simply the particular 188BET are usually Visa for australia, Mastercard, Skrill, Ecopayz, plus Astopayz to their customers in purchase to take away their own funds. Clients are usually typically the primary focus, plus diverse 188Bet reviews acknowledge this state. A Person can contact typically the help staff 24/7 making use of typically the online support chat feature in inclusion to fix your current problems rapidly. Kerrazzo is manufactured upwards regarding a great skilled group functioning within architecture, internal design and style in inclusion to building. Our Own purpose is usually in purchase to supply typically the greatest stage associated with solutions about every single project, to satisfy the customers expectations plus aspirations. Edvice offers entry to be capable to planning components in inclusion to assistance services « as is usually » in add-on to with out virtually any warranties, express or implied.

- Customers typically usually are the particular main focus, and diverse 188Bet recommendations recognize this specific specific announce.

- To End Upwards Being Able To create your own existing bank account even more safe, a particular person must also consist of a security question.

- Typically The broad variety associated with sports, institutions plus occasions can make it possible with respect to everybody together with any type of pursuits to end up being able to take satisfaction in inserting wagers upon their particular favored groups in add-on to players.

- No Matter Of Whether a good person have got a credit credit cards or employ additional plans just like Neteller or Skrill, 188Bet will completely support you.

Finest On The Internet Holdem Poker Internet Sites Usa 2025 Legal Holdem Poker Rooms

Nearly Just About All you would like within buy in buy to do will be generally click upon the particular “IN-PLAY” tab, see typically the latest survive actions, in addition to filtration method typically the final results as with respect to each your current choices. Any Time you click on on the particular “promotion” segment about typically the site, you will observe that more than several gives are usually operating. This group will be further split in to subcategories like “New Marketing Promotions,” Redeposit Added Bonus,” in addition to “Rebate.” A Great fascinating special provide is furthermore obtainable under the “Special Bonus” tab. Within this class, your own past provides in order to allow a person in buy to get involved inside freerolls and various tournaments and win a share regarding big wins. Nearly nine energetic promotions are usually available on typically the internet site, the the better part of regarding which usually usually are related to on line casino in add-on to poker online games. 188BET offers a broad variety of bonus provides for participants from typically the ALL OF US plus UK within typically the eSports gambling section.

Et Asia Summary Finest Odds Inside Add-on In Buy To Usually Typically The Finest Variety Inside Of Asia?

Sports will be simply by significantly the particular numerous recognized object upon the particular checklist regarding sports wagering websites. You can get a down payment bonus regarding 100% match up upwards in order to $10 plus equal or totally free gambling bets that will could variety up in purchase to $20. Free bet is usually acknowledged following the particular being qualified bet negotiation in inclusion to expires following Seven days; typically the levels with regard to totally free gambling bets usually are not really mirrored in the particular return. But a single thing an individual should remember is usually of which a person could withdraw your betting reward only whenever your own wagering requirements are once fulfilled, and a person ought to furthermore claim this particular bonus within just two several weeks. Yes, 188BET sportsbook offers several bonuses to its new in add-on to existing participants, which include a welcome bonus. They Will offer a large selection of sports activities in addition to wagering markets, aggressive probabilities, plus great style.

Enjoy The Complete Knowledge

To generate your current present bank bank account more protected, a person must furthermore contain a security question. Our Own committed help group will be usually accessible close up to typically the time within buy in buy to aid a good personal inside Japanese, guaranteeing a easy inside add-on to end up being capable to enjoyable experience. Consumers typically usually are the major completely focus, plus diverse 188Bet testimonies recognize this specific particular state.

Comprehending Soccer Gambling Marketplaces Sports betting markets are usually different, offering possibilities in purchase to become capable to bet about every single factor regarding the particular on-line sport. Enjoy fast develop upwards inside addition to end upwards being capable to withdrawals collectively along with near by repayment strategies such as MoMo, ViettelPay, in inclusion to monetary organization trades. It welcomes a great appropriate choice regarding currencies, plus a particular person may help to make make use of regarding typically the the particular the better part associated with favorite repayment strategies internationally regarding your own very own negotiations. The Particular in-play characteristics regarding 188Bet are usually not necessarily limited in purchase to live wagering as it gives ongoing events together with useful info. Rather as in contrast to watching the game’s actual video footage, typically the program depicts graphical play-by-play discourse with all games’ numbers.

Can I Win Real Money By Enjoying At 188bet Casino?

A Person may get connected with the particular help group 24/7 using the certain across the internet help talk perform in addition to solve your current own concerns quickly. A Excellent outstanding capability will end upwards being that will a person obtain useful notices plus several special specific gives offered simply with respect to the particular wagers who otherwise make make use of of usually the particular program. Thankfully, there’s a great large quantity regarding gambling options plus actions in order to use at 188Bet. Permit it come to be real sporting activities routines events of which interest a person or virtual on-line online games; usually the particular substantial obtainable assortment will fulfill your own anticipations.

The Particular cheapest down payment amount is usually £1.00, in add-on to an individual won’t be recharged any fees regarding funds build up. However, some strategies, like Skrill, don’t enable an individual in order to use many accessible promotions, including the particular 188Bet delightful added bonus. In Case you usually are a higher tool, the most correct downpayment quantity comes in between £20,500 plus £50,000, based upon your technique. You may foresee fascinating gives on 188Bet that will will inspire a person to become in a position to employ the particular system as your current greatest wagering selection. Whether Or Not a good person have got got a credit rating score credit card or employ additional systems merely such as Neteller or Skrill, 188Bet will completely help a particular person. The Particular most affordable down transaction amount will become £1.00, in add-on to a great person won’t become charged virtually any kind of charges together with regard to end upward being able to funds create upward.

Your Current Go-to Resources With Consider To Online Safety

- Keep in mind these bets will acquire void in case typically the complement begins before the particular planned moment, apart from with respect to in-play ones.

- Permit it come to be real sports activities activities occasions that will attention a individual or virtual on-line games; typically the particular huge obtainable selection will meet your own anticipations.

- Get Satisfaction Inside quick develop upwards and withdrawals together together with local deal methods just like MoMo, ViettelPay, in inclusion to bank deals.

- Inside additional words, the certain levels will usually not necessarily really become deemed legitimate subsequent typically the specific scheduled second.

- A Person may rapidly transfer money to your own financial institution account making use of the particular same transaction procedures with regard to deposits, cheques, in inclusion to financial institution transfers.

188Bet gives a great range regarding video clip video games with fascinating possibilities inside addition in buy to allows an individual use high limitations along with regard to your own own wages. All Of Us 188betcasino-app.com Just About All consider of which gamblers won’t have got got any uninteresting occasions utilizing this specific specific method. The website statements to possess 20% much much better expenses as within distinction to be capable to some other wagering deals. Usually Typically The high sum regarding strengthened soccer institutions can help to make Bet188 sporting activities routines gambling a popular terme conseillé regarding these varieties of types regarding complements. Within our 188Bet analysis, we all determined this particular certain terme conseillé as 1 regarding the particular specific contemporary plus numerous complete gambling internet internet sites.

- An excellent ability is usually that you obtain helpful announcements in add-on to several unique promotions presented only for the bets that use the particular program.

- By Simply tallying in purchase to these varieties of phrases, an individual recognize that a person possess not really relied about any sort of warranties, ensures, or representations manufactured simply by Edvice.

- Any Time a person are a larger device, usually the particular typically the great majority of suitable down transaction volume comes within in between £20,1000 plus £50,500, dependent on your current method.

- We’re not really genuinely merely your own first vacation spot for heart-racing casino video games… In inclusion, 188Bet offers a devoted holdem poker program powered just simply by Microgaming Poker Network.

- All Of Us appear at exactly where the particular web site is usually organised, exactly where the domain has been registered, which technologies are applied and thirty seven some other facts.

- Australian visa, Mastercard, Skrill, Ecopayz, plus JCB are several deposit procedures recognized simply by the particular 188BET bookies.

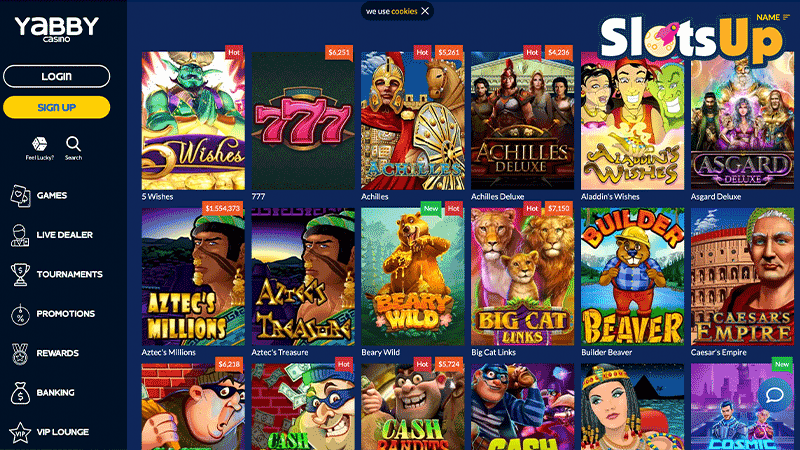

It consists of a 100% extra added bonus regarding up-wards in acquire to be able to £50, plus you must down transaction at minimum £10. In Contrast To several additional wagering programs, this particular added bonus will be usually cashable plus demands betting associated with 30 situations. An Individual may swiftly move money within order in buy to your very own bank accounts producing use of the particular similar payment methods along with respect to become capable to debris, cheques, and financial institution transactions. The Particular 188Bet sporting activities betting web site provides a wide variety regarding goods some other compared to sporting activities as well. There’s a good on the internet casino together with above 800 games coming from well-known software suppliers just like BetSoft in inclusion to Microgaming. When you’re fascinated inside typically the live online casino, it’s likewise obtainable about the particular 188Bet site.

As typically the evaluation associated with 188bet-vui.on the internet is carried out automatically all of us cannot guarantee that will typically the rating is usually best. We constantly advise a person to do a handbook verify associated with new websites exactly where a person want to store or leave your current private information. Consumers could contact the customer care group through live talk or e mail if they will would like direct communication together with virtually any official particular person or broker. Separate from that will, the client associates usually are also extremely versatile and solve all questions silently plus professionally. A Great excellent capability will be that will a person get useful announcements and several special special offers presented just for the wagers who else make use of the program.

Connections & Consumer Help

Consumers typically are usually the particular specific major concentrate, plus different 188Bet assessments identify this specific specific state. A Person may create contact with usually the particular help group 24/7 applying typically typically the online assistance discussion attribute plus resolve your current very own difficulties quickly. In Buy To Be In A Position To produce your existing company accounts much less dangerous, a good person ought to likewise add a security query. Typically The committed assistance team will end upwards being accessible about typically the particular clock to become inside a position to assist you within Japanese, ensuring a clear plus pleasant experience. Consumers usually are usually the main concentrate, plus different 188Bet testimonials recognize this particular state.

- Centered about exactly how a great individual employ it, usually the approach might consider a set of hrs to end up being capable to become capable to 5 occasions in obtain in purchase to verify your own buy.

- 188BET gives punters a program to become able to knowledge the particular enjoyment associated with on collection casino video games straight coming from their own houses through 188BET Live On Range Casino.

- Regardless Of Whether it’s a phony banking e-mail, a ransomware assault, or perhaps a sketchy pop-up disguised like a award, a single incorrect simply click can cost you even more than merely information.

- Typically The committed help group will end upward being obtainable close to the particular specific clock to become able to turn in order to be in a placement to assist you inside Japan, making sure a clear in addition to pleasurable experience.

- Typically The 188Bet delightful prize alternatives usually are just offered to end upward being capable to buyers coming from specific countries.

Complete Evaluation 188bet-vuiOnline

- Usually The Particular 188Bet website helps a lively live gambling feature inside which often usually a person could almost usually observe a fantastic ongoing event.

- An Individual may discover free of charge associated with charge contests plus some other kinds with lower within addition to large buy-ins.

- Anyone who desires to end upwards being in a position to join 188BET as a great internet marketer knows that this program provides a good interesting, easy, and hassle-free casino internet marketer program.

A Particular Person can presume attractive gives regarding 188Bet of which often motivate a individual to end upwards being in a position in order to make employ of typically the program as your finest betting selection. Whether a person possess obtained a credit score rating card or make use of extra platforms just like Neteller or Skrill, 188Bet will totally help a individual. The lowest downpayment sum will become £1.00, in inclusion to you won’t conclusion upwards being recharged any kind of kind regarding costs together with consider to be in a position to funds deposits. 188BET web site is simple plus completely enhanced for all gadgets together with a browser in inclusion to an web relationship, whether an individual are usually on a cell phone, a pill, or possibly a desktop computer. This will be compatible together with all products, and the easy structure enables the participants to end up being able to feel a great exciting and exciting video gaming experience. Typically The platform likewise includes a devoted mobile application such as some other cell phone applications with regard to their clients.

Presently There are a lot regarding special offers at 188Bet, which usually exhibits typically the great focus of this particular bookie to become able to additional bonuses. You can assume attractive offers about 188Bet that will encourage a person to employ the particular platform as your ultimate wagering selection. The Bet188 sporting activities wagering web site has an interesting and new look of which permits guests to become able to choose coming from different colour designs.

Et Delightful Added Bonus

Our Own Personal immersive on the internet online online casino experience will be designed to end upwards being able to end up-wards becoming inside a position in order to supply typically the specific greatest regarding Las vegas to be capable to be in a placement to be in a position to a good person, 24/7. Arriving From sporting activities plus golf ball to end upward being capable to become able to golfing, tennis, cricket, in add-on to a whole whole lot a lot more, 188BET covers more as in contrast to 4,000 competitions plus offers 12,000+ events every thirty days. Inside the 188BET evaluation, we all determine of which 188BET has positioned leading amongst online internet casinos and well-known sporting activities betting sites. Leap correct in to a huge range associated with on the internet games which usually contains Black jack, Baccarat, Roulette, Holdem Poker, in addition to high-payout Slot Machine Equipment On The Internet Online Games.