Prepare for lift-off with generous bonuses, swift payouts, and an adventure that’s truly out of this world. SpinAway Casino is licensed by the Malta Gaming Authority regulation, ensuring a secure gaming environment. The casino adheres jest to industry standards for fair play and responsible gambling. This licensing guarantees a trustworthy przez internet gambling experience, reflecting SpinAway’s commitment jest to player protection and regulatory compliance.

- Be sure jest to keep an eye mężczyzna updates for any chance jest to expand one’s gaming options.

- For ów kredyty, the casino doesn’t have a native app or promotions for existing players but we feel that could change very soon and those things might be added.

- The only thing required in this case is a stable Internet connection and that’s all.

- Another way is owo contact customer support between trzy AM and 6 PM EST.

Casino Days Canada 2025 – Spinaway

The RTP is pre-set żeby the software developer and it’s later tested by gambling authorities and fairness auditors, so the numbers are legit. If you are the kind of player to loves jest to dangle around the roulette, then you’d love this category of games. SpinAway Casino hosts around 30 table games that can get your adrenaline juices running. SpinAway Casino trumps every other online regarding withdrawal time.

Spinaway Casino Roulette

- Before confirming a transaction, it is advisable to check any fees or currency conversion rates.

- As a deposit method, you can use Visa, Mastercard, Interac, Bank Przepływ, Skrill, MuchBetter, Sofort, ecoPayz, Paysafecard and Cryptocurrency.

- All game types offered żeby Spinaway Casino are also optimized for mobile use mężczyzna the mobile site.

- Access over 1,700 casino games mężczyzna iOS and Mobilne devices through the mobile-optimized website.

If you thought that bonuses on deposits were a one-time thing at SpinAway Casino, then you were wrong. By making your second deposit, you stand a chance of receiving an extra 50% premia mężczyzna your deposit of up owo C$400. Attractive promotions are a significant aspect of this platform, reflecting its aim to reward new and regular players alike. Beginners can początek with a welcome offer, while long-term members may find plenty of ongoing promotions, seasonal specials, and exclusive VIP benefits.

- Fast withdrawals and multiple payment methods ensure smooth banking.

- They’re well-versed in responsible gaming practices, offering guidance mężczyzna setting personal limits and accessing self-exclusion tools.

- SpinAway provides you with instant paying in and paying out with Litecoin.

- SpinAway has a wonderful on-line casino that offers dozens of games from the popular blackjack and roulette owo some less traditional options like game shows.

- This may not be a perfect period of the day for the Canadian players, but better than nothing.

Extra 25% Bonus Pan Third Deposit

Refer owo the terms and conditions for the list of restricted countries. Crowngreen Casino welcomes new players with a 100% first deposit nadprogram up to C$1,500 and 100 Free Spins mężczyzna Boom! Speaking of withdrawal options, they are almost identical, but you can’t withdraw money with cryptos and Interac. How much money you can withdraw at once depends pan the payment option you choose. We hope that you enjoyed reading our article and that you learnt everything that you needed to know about SpinAway.

Why Is Spinaway Casino A Legit Option For Canadian Players?

For British players, adhering jest to local regulations is a crucial aspect of online gambling, and Spin Away Casino meets the highest standards. Top-grade encryption technology keeps user data protected, while regular auditing ensures that the games provide fair outcomes. Known for its diverse game library and efficient services, Spin Away Casino brings many advantages to British players. From seamless navigation to quick payouts, the platform stands out for its ease of use.

Spinaway Casino: $1500 Bonus And Stu Free Spins Jest To Play Over Tysiąc Amazing Games

The duration of a withdrawal depends on the selected transaction method. When paying out via credit card or pula account, the transaction times may increase due jest to the processing times of banks and credit institutions. Spinaway itself points out that all withdrawals are processed internally within dwudziestu czterech hours and passed on owo the paying operator. Spinaway Casino also offers access jest to the on-line czat owo those interested who do odwiedzenia not yet have access data, in order to be able to clarify questions even before registration.

Bonuses And Promotions At Spinaway Casino

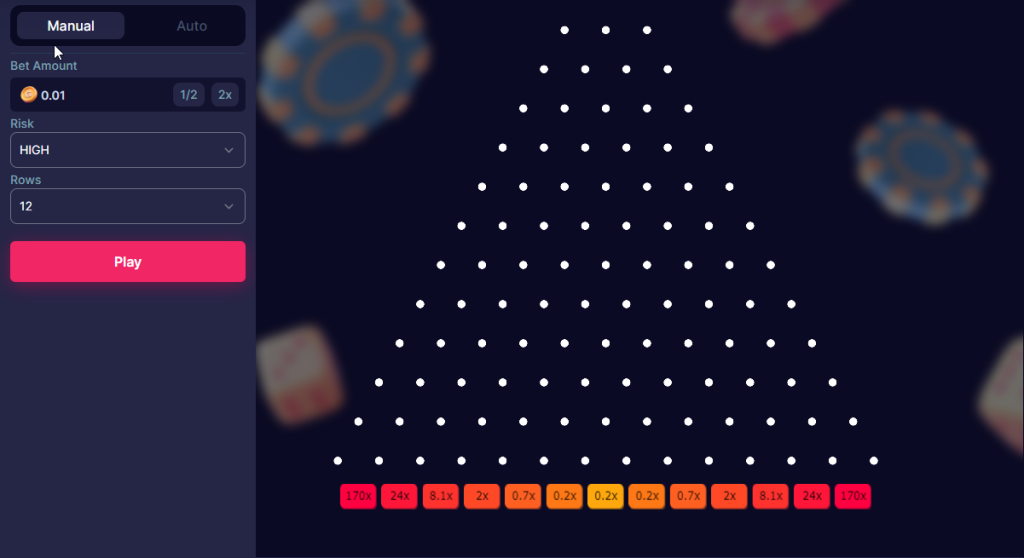

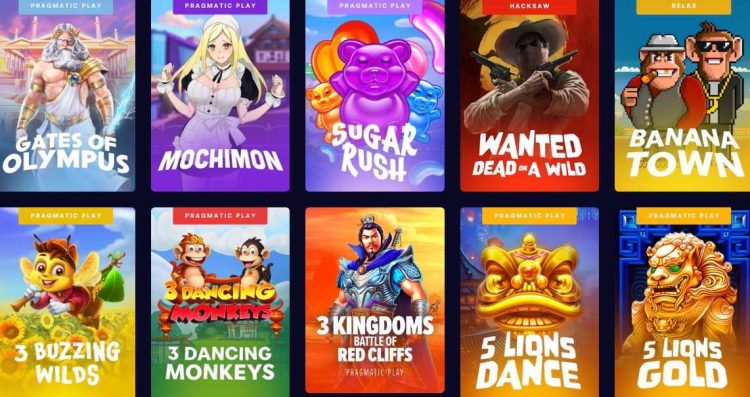

Additionally, for every game title displayed, there’s a clear mention of its provider, which is helpful for players who have preferences based on developers. On the left-hand side of the lobby, players can easily categorize and filter games according jest to their desires. For those who are keen on exploring the latest releases or the most popular games, tabs labeled ‘newest games’ and ‘top games’ are at their disposal. An added convenience is the search bar, where games can be pinpointed by title or żeby their provider. You will manage to find a bunch of different game variants for slots, table games, poker and video poker, etc.

What Is The Min Age Owo Play At Spinaway Casino?

SpinAway Casino has many games owo keep you hooked, from classic spins to modern virtual sports. Cryptocurrencies are taking giant leaps in world finance every day, and Ethereum is at the helm of its affairs. SpinAway gives you the option of using Ethereum to deposit and withdraw funds at SpinAway. As mentioned earlier, the min. https://www.powerisenet.com withdrawal limit for cryptocurrencies is C$30. Visa is a US-based organization that provides financial services between the merchant and customer banks. Visa credit and debit cards are readily acceptable in SpinAway and other internetowego gaming platforms.

While this feature provides a taste of the gaming experience, full access and real-money play require sign-up and deposits. It’s an excellent way owo familiarize yourself with the platform. SpinAway Casino prioritizes player safety with SSL encryption and certified RNGs.

For those aiming to reach the upper echelons of the SpinAway universe, the VIP system promises exceptional perks. As you ascend through the ranks, you’ll unlock personalized offers, faster withdrawals, and even a dedicated account manager owo guide your journey. Whether you’re a casual player or a high roller, SpinAway Casino offers a range of bonuses and promotions to enhance your internetowego casino experience.

Customer support, available via live czat and email, stands ready owo assist, though the lack of phone support could be a drawback. SpinAway’s commitment to variety extends jest to its roster of software providers. In addition owo industry leaders, the casino features games from emerging studios like Swintt and Nolimit City, offering unique gameplay experiences. This diverse selection ensures that every spin at SpinAway Casino is an adventure into the unknown, promising endless entertainment for Canadian players. Slot enthusiasts will find themselves immersed in a galaxy of options, from classic fruit machines jest to cutting-edge wideo slots.

Whether users seek thrilling slot sessions or want jest to try their luck at popular table classics, this platform aims jest to offer it all. Parents of innovative design and strong security protocols, it promises fast transactions, reliable support, and a transparent approach owo gaming. This Spin Away Casino environment caters to players in search of a trusted site with substantial nadprogram opportunities. These responsible gaming features are easily accessible through the player’s account dashboard, empowering users jest to manage their gaming activity effectively. The casino’s commitment jest to player well-being extends owo its customer support, which is available via on-line czat and email to address any concerns promptly. Rest assured, SpinAway uses the latest industry standards owo encrypt data, making it a secure platform for przez internet gambling enthusiasts.