We All hope of which you loved studying the article in add-on to of which a person learnt every thing that an individual needed to become capable to realize concerning SpinAway. Beneath you can furthermore find the particular most popular queries regarding the particular operators, but in case an individual have any type of other folks, please reach out there to end up being capable to see -casinos.apresentando. Typically The organization of which owns it is NGame N.Versus. Typically The organization at present only offers one gambling product which is usually SpinAway online casino by itself. SpinAway online casino provides controlled given that 2020 and it’s available within several nations all around the particular globe.

Wherever Could I Find Typically The Spinaway Online Casino Reward Code?

- Whether you’re inside Ontario or just about everywhere inside North america, Spinaway Online Casino claims a seamless in addition to fascinating trip.

- Gamers could set downpayment limits, opt regarding self-exclusion, in inclusion to access assistance companies.

- A Few just one,300 slot machines usually are available to play at Spinaway Online Casino plus these kinds of appear inside a wide selection regarding designs and styles.

- In Case you prefer game gameplay, after that definitely consider a appearance at typically the unique board video games, the amount regarding which often furthermore pleases.

- It’s effortless to find your own approach around this specific venue, together with online games being categorized plus information obviously organized.

When it will come to analyzing quality, participant views factor seriously in to virtually any Spin Apart Casino review. Many comments highlight speedy transactions, interesting bonus deals, and the ease regarding locating preferred games. Consumers likewise enjoy the particular high-grade encryption measures that keep their particular information secure.

🐦🔥 Reliable Client Assistance At Spinaway

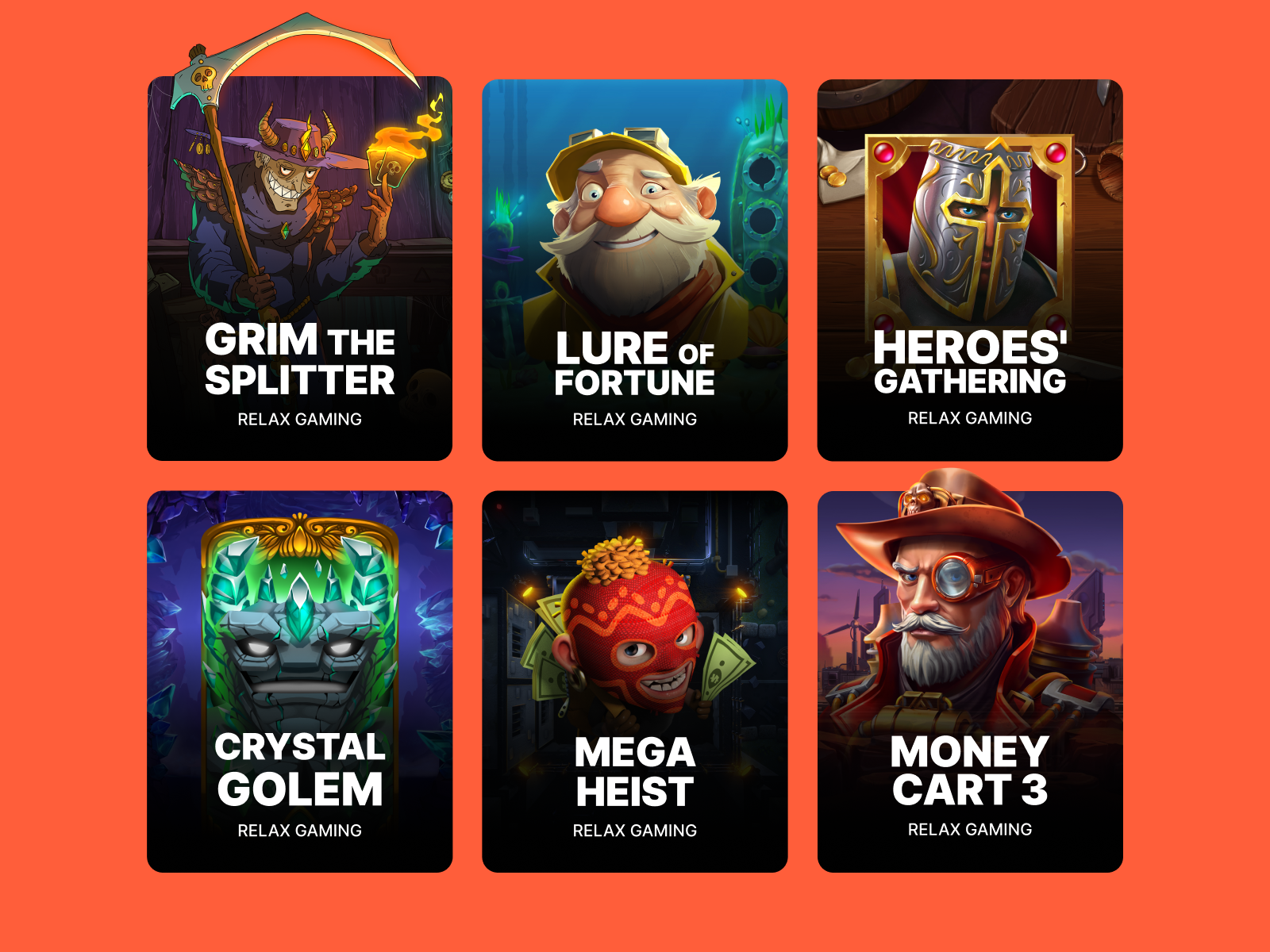

Inside terms associated with software program suppliers, a person may locate some associated with the particular many popular game companies in the particular industry. SpinAway on the internet online casino characteristics online games by giants such as NetEnt, Advancement, in inclusion to Red Gambling among several others. An Individual can type a software creator within typically the lookup pub to see all their video games. We are usually overall pleased simply by typically the online game assortment at SpinAway online online casino. The Particular method we review online game libraries provides to become capable to carry out with the particular kinds regarding games available, or whether all online casino video games are displayed plus how numerous variations of these people presently there are. All Of Us furthermore appear at application suppliers together with the particular maxima associated with “the a great deal more, typically the better”.

- In addition, typically the 35 times expiration reduce is pretty good in comparison to end upward being capable to additional casinos.

- Once your own disengagement request provides already been accepted, it may get upwards in order to five company times for your current money in order to turn up dependent on typically the payment method you’ve selected.

- Payout costs are usually pre-set simply by typically the game’s creator and they are later on examined by multiple self-employed firms before they will conclusion upward on typically the on line casino web page.

Just How Quick Are Usually Spinaway Drawback Times?

Regarding all those who else are enthusiastic upon exploring the newest emits or the particular many popular games, tab tagged ‘newest games’ in addition to ‘top games’ are usually at their particular disposal. An additional comfort will be the search pub, where video games may end up being pinpointed by simply title or by simply their particular service provider. SpinAway On Range Casino tends to make it actually simple with consider to Canadian players in buy to commence rotating away upon slot machine game video games thanks to become in a position to their superb internet site style. Their basic and intuitive software help to make the particular gaming experience about typically the internet site clean, and this will be combined if not necessarily exceeded simply by the particular cell phone variation. It only can make sense to begin this particular evaluation by simply 1st looking at the particular SpinAway video games as they are one associated with typically the main selling factors of typically the on range casino.

Spinaway Casino Down Sides:

Enthusiasts of intensifying jackpot feature slot machine games will furthermore obtain their own money’s well worth. They Will have the selection among Divine Lot Of Money, Huge Moolah in add-on to Significant Thousands through Microgaming, among other folks. Spinaway provides done a great career associated with categorizing the games in accordance to different focuses in addition to styles. Just What will be continue to missing therefore much will be a filtration with which often it is possible to filtration system the slot device games in addition to sport types provider-specifically.

Exactly How May I Deposit In Addition To Pull Away At Spinaway?

Additionally, the owner has received solid assistance coming from business specialists, showcasing the determination in order to accountable gambling. Along With proven safety plans, the particular on collection casino strives to become able to ensure a protected atmosphere for deposits and withdrawals as well, offering participants typically the self-confidence they will require. SpinAway Online Casino welcomes fresh participants together with a good reward package, featuring one hundred free of charge spins and significant down payment complements across your current 1st 3 deposits.

- The added bonus program at Spinaway Casino will be typically the major trademark regarding the project.

- This added bonus is available to new participants from Europe (excluding Ontario).

- There’s furthermore a file publish alternative on your own account in add-on to beneficial info regarding the particular process within Frequently asked questions and phrases and problems.

- The Particular user-friendly user interface assures a soft experience, producing the particular program ideal actually regarding beginner-level fanatics.

- This Particular personalized method guarantees of which normal gamers really feel treasured and incentivized to continue their particular video gaming quest at Spinaway.

For fast solutions to become capable to typical questions, the COMMONLY ASKED QUESTIONS segment upon the web site is also a important reference. It covers typically the indicators in buy to look away for, along with offering advice through typically the support team. You’ll want to spin casino canada complete 2 steps inside the particular registration procedure to generate your own accounts at Rewrite Away On Collection Casino.

The bonus program at Spinaway Online Casino will be the main characteristic associated with typically the project. The Particular administration resorts in buy to this sort of categories associated with special offers as down payment, no-deposit, special, weekly, everyday, month to month, in addition to actually individual. Inside addition, all customers automatically sign up for the commitment program with extremely profitable items. Right Now There is usually simply no full-on mobile Spinaway On Range Casino app, as an option, the particular mobile web variation associated with the particular source will be provided. Just entry the project through virtually any mobile web browser, right after which the system will automatically modify to the particular features in add-on to image resolution of your current device.

Rewrite Apart Online Casino Totally Free Spins Plus Added Bonus Code

Typically The online casino features a great considerable collection of slot device game video games, varying from traditional 3-reel slots in buy to typically the latest video clip slots along with gorgeous images plus impressive designs. Well-liked titles consist of « Starburst, » « Book of Dead, » and « Gonzo’s Quest. » Each And Every game offers unique functions in addition to bonuses, guaranteeing limitless amusement and possibilities to be capable to win. Although there is at present zero devoted Spin Aside Online Casino software, the mobile-optimised web program offers a clean encounter on all mobile phones plus capsules. Gamers could appreciate instant access to games, banking, plus Spin Aside On Collection Casino Login through anywhere within New Zealand.

Quick customer help will be accessible via live chat plus e mail regarding any questions or support required. Giving extensive entertainment, Spin Away Online Casino sticks out like a dependable hub with regard to traditional plus contemporary online casino games alike. Their prize program, solid level of privacy protection, and varied banking choices make it appealing to a wide selection of British gamblers.

A Few regarding the particular video games vary inside terms associated with functioning gestures and quality. This approach, cellular video gaming gets even more cozy plus information targeted traffic could end up being lowered to avoid relationship issues about typically the go. Spinaways offers individuals serious who usually carry out not yet have their own very own bank account the opportunity to become able to check all types associated with play in a trial edition. To carry out so, basically click upon your current preferred game, which will then weight automatically inside the particular web browser.